Part 7: Inflation – True Cause, Not Glaring Symptoms

September 20, 2021

Until recently, the last significant bout of inflation suffered by the U.S. economy was in the 1970s.

In 1971, President Richard Nixon reacted to a 5.8% inflation rate by imposing wage and price controls in an effort to break a rising wage and price cycle. Nixon presented his program to the American people as a way to stop the “price gougers,” and the public initially approved. But the ill-conceived project utterly failed to prevent the onset of stagflation (chronic unemployment and inflation). The controls were extended until 1973 when they were mercifully repealed.

In 1974, President Gerald Ford inherited stagflation. He responded by initiating a second attempt to arrest rising prices. Even at a rate of just 4%, inflation was considered problematic because it was creating a new public behavior – the expectation of continuous increases in both wages and the prices of goods and services. The prevailing Washington D.C. narrative echoed by Ford and his economists was that the psychology of anticipated inflation actually caused the rising prices of labor, products and services in a self-perpetuating cycle. The government’s goal was to break the cycle and end the expectation of rising prices. They intended to restore price stability by creating a new psychology.

In 1974, President Gerald Ford inherited stagflation. He responded by initiating a second attempt to arrest rising prices. Even at a rate of just 4%, inflation was considered problematic because it was creating a new public behavior – the expectation of continuous increases in both wages and the prices of goods and services. The prevailing Washington D.C. narrative echoed by Ford and his economists was that the psychology of anticipated inflation actually caused the rising prices of labor, products and services in a self-perpetuating cycle. The government’s goal was to break the cycle and end the expectation of rising prices. They intended to restore price stability by creating a new psychology.

Due to the recent failure of Nixon to effectively mandate price controls, President Ford opted for a voluntary approach. He called his new program, WIN – Whip Inflation Now. It was introduced with much fanfare, including a WIN badge that was to be worn with the pride of fulfilling one’s civic duty. Although Ford’s plan was voluntary, businesses were expected to not raise prices, and labor was encouraged to not demand pay increases.

Due to the recent failure of Nixon to effectively mandate price controls, President Ford opted for a voluntary approach. He called his new program, WIN – Whip Inflation Now. It was introduced with much fanfare, including a WIN badge that was to be worn with the pride of fulfilling one’s civic duty. Although Ford’s plan was voluntary, businesses were expected to not raise prices, and labor was encouraged to not demand pay increases.

But “Whip Inflation Now” was doomed to an embarrassing failure for one simple reason, rising wages and prices are the consequence of inflation, they don’t cause it.

Yet despite the policy fiasco, the true cause of inflation was to remain veiled behind the curtain for one more administration. This time it was the Democrats’ turn as President Jimmy Carter continued the D.C. blame-game of finding scapegoats for the government’s fiscal malfeasance.

In October of 1978, Carter announced his wage-price guidelines to establish voluntary limits of 7% for wage raises and 5.75% for price increases. But to ensure that this new program didn’t suffer the same fate as Ford’s WIN failure, Carter’s “voluntary” guidelines would be “enforced” by government sanctions.

In October of 1978, Carter announced his wage-price guidelines to establish voluntary limits of 7% for wage raises and 5.75% for price increases. But to ensure that this new program didn’t suffer the same fate as Ford’s WIN failure, Carter’s “voluntary” guidelines would be “enforced” by government sanctions.

To administer his directives, Carter ordered the Orwellian-sounding “Council on Wage and Price Stability” and it’s new “Wage-Price Czar” to enforce the guidelines, monitor compliance, draft new regulations and mete out sanctions against violators.

Did it work? Just 18 months later, inflation rose from 7.5% to over 14.5%.

But the sham could not be maintained and the true source of inflation was about to be exposed.

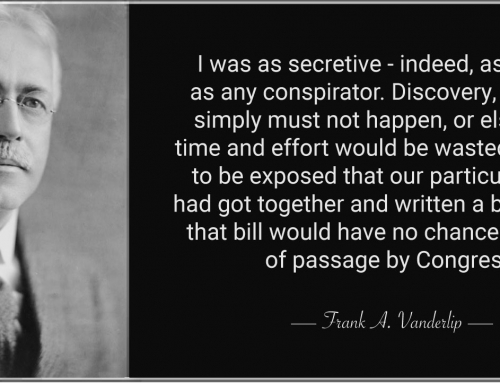

In 1980, economist Milton Friedman entered the debate and pulled back the curtain on the great deception of the 1970s – Washington D.C. and the Federal Reserve, not businesses and labor, were the sole cause of inflation.

In 1980, economist Milton Friedman entered the debate and pulled back the curtain on the great deception of the 1970s – Washington D.C. and the Federal Reserve, not businesses and labor, were the sole cause of inflation.

Coming – Part 8: Exposing the Government’s Inflation Narrative as Political Fraud