Part 10: The Inflation Psychology Whirlwind

Despite mounting evidence to the contrary, the Federal Reserve and Biden Administration continue to insist that inflation is “transitory.” In other words, they claim it is a temporary phenomenon caused by unique circumstances related to the economic recovery from the pandemic.

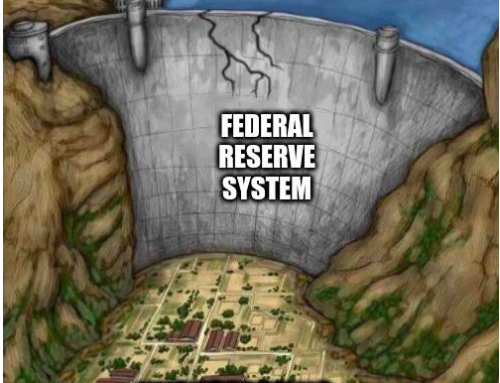

So why is it important for the Federal Reserve to cling to a transitory view of rising prices when such an explanation appears increasing unrealistic? The answer is that they desperately want to avoid the adverse effects anticipated future inflation has historically had on economic activity. Therefore, the politicians in D.C. and their allies in the Federal Reserve must control the inflation narrative in order to prevent the public from developing an “inflation psychology.”

If they succeed in convincing the public that specific price increases are due to isolated events such as supply disruptions or bad weather, then people are more apt to hang on to their dollars waiting for prices to stabilize. But if the public begins to anticipate rising prices continuing into the future, then a potential economic whirlwind is released as inflation psychology takes over.

By inflation psychology, we mean that the public’s attitude towards inflation changes and begins to affect spending habits. When future inflation becomes anticipated, people will unload their depreciating paper currency for tangible assets such as real estate, durable goods, art and collectibles, gold and silver, toilet paper and anything else they might need in the future. In other words, they buy today whatever they believe will hold its value as their currency continues to be devalued.

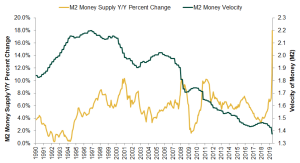

This is why the Fed fears inflation psychology becoming a primary driver of economic activity. When the public loses confidence in the government’s ability to ensure the integrity of its currency, the value of savings is diminished. Spending and debt are rewarded. Consequently, people spend their money more quickly, which increases the velocity of money (the total turnover of the money supply in a given year.)

The following chart shows that since the late 1990s, the velocity (or turnover) of money in the economy has slowed. A great deal of this new currency was invested in the stock market and real estate, and never found its way into the general economy. This allowed the Federal Reserve to expand the money supply, especially during the financial crisis of 2008 and the subsequent quantitative easing, without creating significant monetary inflation. But since the start of the pandemic, the unparalleled increase in the money supply could not be totally absorbed into savings and investments. It has flowed into the general economy causing consequential monetary inflation.