Chapter 9 – Magic Money: Wealth without Wisdom, Sacrifice or Work

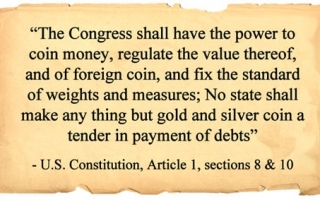

Chapter 9 – Magic Money: Wealth without Wisdom, Sacrifice or Work By David Kullberg True money has integrity. It’s an object of real, tangible wealth that can be used as an honest medium of exchange. Therefore, true money can only be created by natural resources, productive labor, and creative enterprise. It cannot be imagined into existence by wishful thinking or human legislation. It is real, grounded in the reality of the Creator/creation distinction. The antithesis of true money is “magic money” commonly called fiat currency. The original intent of paper currency notes issued by banks and governments was for the [...]