Part 2: America’s Economic Fate Is Now Being Decided

April 9, 2021

Wow! With breath-taking speed, the economic reaction to the Covid pandemic was mind-boggling. From Donald Trump to Joe Biden, from trillion dollar stimulus packages to unending Federal Reserve liquidity, the scope of the response has been without parallel. The world’s economic engine sputtered from forced lockdowns and massive unemployment. Trillions of dollars were borrowed from the future, piled on top of mountains of previous debt. Interest rates were cut to zero, and national governments and their central banks flooded the world financial system with newly created currency.

Before the present crisis began, the writer of this blog anticipated that the issues delineated in Part 1, The Battle for America’s Economic Future, would play out over the next few years. But the U.S. government and the Federal Reserve’s response to the pandemic has brought every economic assumption into question, all at once, including America’s traditional free enterprise system. At this point, it would be naïve to assume that there is any way back to normal economic activity.

For some time, there has been a hope among the advocates of America’s traditional free enterprise system that the fallacies and harmful ideas of Socialism, Modern Monetary Theory, negative interest rates, central bank money creation and a global currency were self-evident, to be banished on the ash heap of bad ideas. But not only have these ideas not diminished, they are now part of the current economic debate. In other words, the unimaginable is suddenly upon us – America’s economic hangs in the balance.

But before addressing these issues, which we will do in future posts, we must first recognize that the primary driver of the American economy is the Federal Reserve.

So what is the Federal Reserve?

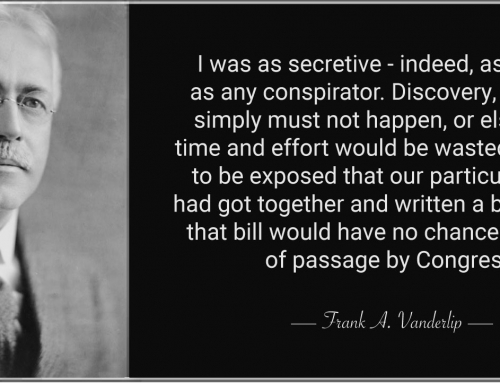

Although President Woodrow Wilson and Congress created the Fed in 1913, the structure of this new Central Bank was developed by the New York banking establishment. In order to more effectively control America’s wealth, the financial elites met in secret in 1910 on Jekyll Island, Georgia. They gathered for several days to devise a plan that would mislead Congress and the American people into believing that it was in the public interest to create a Federal Reserve System that would stabilize the economy and protect the public from future the bank failures.

For the past one hundred years, instead of achieving economic stability, the policies of the Fed have more successfully facilitated the transfer of wealth to the “1%” at the expense of Middle America.1

For Christians, we are called to love our children, grandchildren and neighbors by addressing the issues of the day from a biblical perspective. Therefore, we have a responsibility to understand the Federal Reserve and other policy issues so that we can apply biblical reasoning to the economic principles competing for dominance.2 The future prosperity and freedom of our families, communities and nation will depend upon it.

Coming – Part 3: How We Got Here – the Panic of 1907

[1] Support of these assertions concerning the actions and the debatable objectives of the Federal Reserve will be the addressed in many subsequent articles on “The Fed, Money & Debt.”

[2] For a Christian view of economics from a theological perspective, see our companion blog, God and Mammon